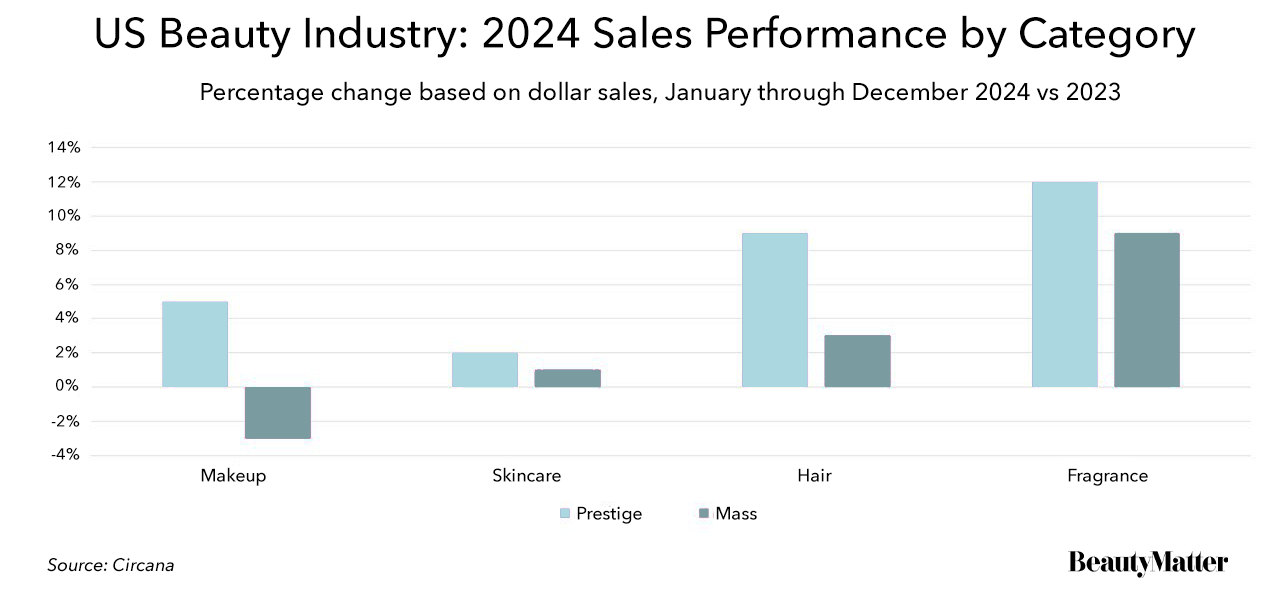

US beauty industry sales grew for the fourth consecutive year across mass and prestige, according to Circana’s year-end data. The prestige, which includes department and beauty specialty retailers, is up 7%, hitting $33.9 billion, while mass showed 3% growth. Fragrance was the breakout category across both prestige and mass, growing the fastest and becoming the second-largest prestige beauty category for the first time.

“The beauty industry’s resilience continues to shine as consumers turn to beauty to not only look, but also feel good,” said Larissa Jensen, Global Beauty Industry Advisor at Circana. “With beauty products intertwined with consumers’ emotional needs and wellness routines, maximizing this opportunity will go a long way to ensure a healthy future for our industry.”

Fragrance

Skincare

Makeup

Hair